Replacing Your Mortgage for Cash

Key Takeaways:

Cash-out refinancing allows homeowners to replace their current mortgage with a larger loan and receive the difference as cash.

Compared to regular rate-and-term refinancing, cash-out refinancing is typically more expensive.

Homeowners should consider the costs of cash-out refinancing and compare it to a rate-and-term refinance plus a home equity loan.

Table of Contents

If you own a home and need additional funds for various purposes, such as home improvements or paying off debts, a cash-out refinance may be an option worth considering. With a cash-out refinance, you replace your existing mortgage loan with a new one that is larger, allowing you to receive the difference as cash at the closing.

This article explains how cash-out refinancing works, who is eligible for it, and when you can expect to receive the cash.

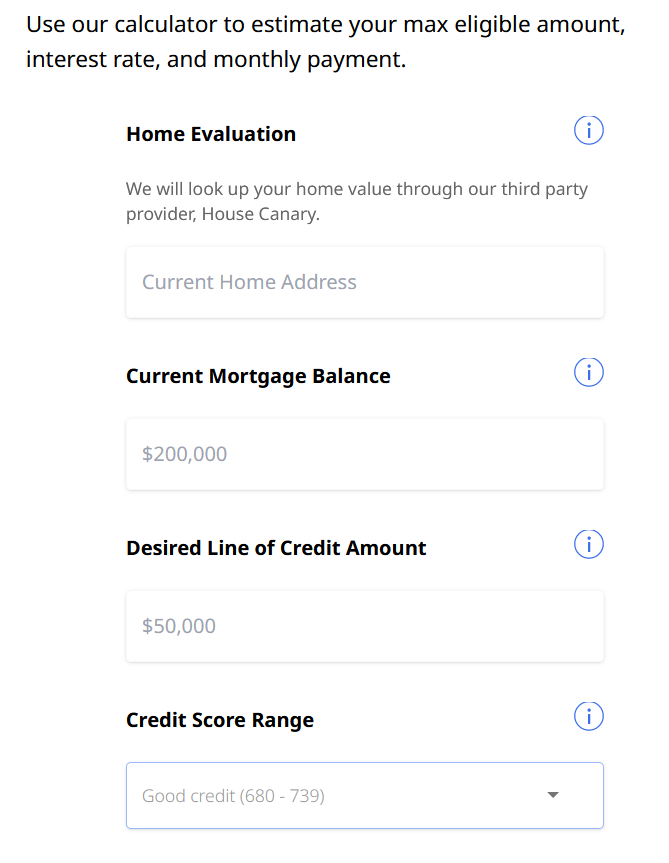

When you need extra funds while owning a home, you have several options, including applying for a home equity loan, a home equity line of credit (HELOC), or a personal loan. Alternatively, you can choose to refinance your existing mortgage and receive cash during the transaction, known as a cash-out refinance.

"A cash-out refinance is a loan option that enables homeowners to replace their current mortgage with a new one, taking out equity from their property in the form of cash. The customer refinances the loan for a higher amount than owed, and the difference is paid out as cash," explains Sean Grzebin, head of Consumer Originations at Chase Home Lending.

A cash-out refinance provides an opportunity to lower your interest rate while accessing funds for important needs or life goals.

The process of a cash-out refinance is relatively straightforward. You pay off your existing mortgage loan with a new loan that has a higher balance. The cash you receive at closing is the difference between the amount you pay off and the new loan balance.

"This differs from a traditional rate-and-term refinance because you are adding money to your original mortgage balance, resulting in a larger loan amount," explains Mike Bevilacqua, CEO of Dominus Properties.

A cash-out refinance requires using your home as collateral for the new loan. It's important to note that if you fail to make your monthly mortgage payments on time and in full, you risk losing your home.

To obtain a cash-out refinance, you need to find a lender willing to work with you. The lender will assess the terms of your current mortgage, the remaining balance, and your credit profile before making an offer based on their underwriting analysis, as Dmitry Kondratiev, an attorney with LLC.Services, explains.

However, it's important to consider that cash-out refinancing typically comes with a higher interest rate or additional fees compared to a rate-and-term refinance. Additionally, with recent increases in mortgage rates, finding a loan with a lower rate than your current mortgage may be challenging.

Similar to most mortgages, a cash-out refinance involves closing costs and fees, usually ranging between 2% and 5% of the new loan amount. For example, if you are taking out a $180,000 loan, you can expect closing costs ranging between $3,600 and $9,000.

To be eligible for a cash-out refinance, you need to meet certain requirements. According to Kondratiev, these requirements typically include:

1. Home equity of at least 20% after completing the cash-out refinance.

2. A new appraisal that demonstrates sufficient home value.

3. Verifiable and sufficient income.

4. A credit score of 620 or higher.

5. A debt-to-income (DTI) ratio of 43% or less.

"Homeowners who recently purchased their homes may not qualify for a cash-out refinance as they haven't had enough time to build sufficient equity," warns Grzebin.

LTV and home equity requirements in a cash-out refinance

The loan-to-value ratio (LTV) compares your current mortgage balance to the appraised value of your home. To calculate the LTV ratio, divide your loan amount by your property's appraised value, and multiply by 100. For example, if your new refinance loan amount is $200,000 and your home is appraised at $300,000, your LTV ratio would be 66.6%.

"Lenders use the LTV ratio to evaluate your eligibility for a cash-out refinance. While each lender has different criteria, most don't allow an LTV ratio exceeding 80%," says Bevilacqua.

Credit score requirements

Different loan types have varying minimum credit score requirements for a cash-out refinance.

"For a conventional loan cash-out refinance, you typically need a credit score of at least 620," notes Leonard Ang, CEO of iPropertyManagement. "An FHA cash-out refinance loan may require a score of 580 or even lower, depending on the amount of equity in your home. VA and USDA loans, on the other hand, do not have specific credit score requirements for a cash-out refinance, although individual lenders may set their own criteria."

DTI requirements

Your debt-to-income (DTI) ratio is a calculation of all your monthly debt payments divided by your gross monthly income. Mortgage lenders use this ratio to assess your ability to manage and repay your debts.

For example, if you pay $1,500 monthly for your mortgage, $100 for an auto loan, and $400 for other debts, your total monthly debt payments would be $2,000. If your gross monthly income is $6,000, your DTI ratio would be $2,000 / $6,000 = 33%.

"Most lenders require a DTI ratio of 43% or lower to qualify for a cash-out refinance. However, some lenders accept ratios as high as 50%, while others prefer a lower DTI of 40%," adds Kondratiev.

Before deciding on a cash-out refinance, it's essential to consider your financial situation, job stability, urgency for extra funds, and the associated closing costs.

"The past two years of the pandemic have encouraged many homeowners to focus on improving their living spaces and undertaking planned renovations. Cash-out refinancing can be an option for homeowners to fund such projects or necessary repairs," says Grzebin. Investing in home improvements can be a worthwhile endeavor as it can increase the value of your home and, subsequently, your equity.

Another reason to consider a cash-out refinance is to fund education expenses. Paying for tuition, room and board, and other education costs can be financially burdensome, especially if you don't qualify for free financial aid.

"Additionally, if you previously had an adjustable-rate mortgage and want to switch to a fixed-rate mortgage, a cash-out refinance can be helpful. Refinancing allows you to secure a fixed interest rate, providing peace of mind by eliminating concerns about future rate changes and enabling you to plan your budget in advance," explains Kondratiev.

Furthermore, if you have significant high-interest debt, such as credit card debt with double-digit interest rates, it may be wise to use the cash obtained through a cash-out refinance to pay off those debts during the refinancing process.

However, it's crucial to carefully consider all your options before committing to a cash-out refinance. Depending on your circumstances, a rate-and-term refinance combined with a home equity loan or home equity line of credit may be more cost-effective. Cash-out refinancing typically incurs surcharges ranging from 0.5% to 4% of the entire loan amount, not just the cash-out portion. It is often most beneficial when your existing mortgage is relatively small, and you require a substantial cash-out amount.